Going through a divorce is tough enough, and it gets even trickier when you’re a part of the Texas Teacher Retirement System (TRS). One thing you might bump into is something called the Windfall Elimination Provision (WEP). This rule can really change the game when it comes to figuring out your Social Security benefits if you’re a public employee, like a teacher.

In our first article, Divorce and Texas TRS – Navigating Social Security and Government Pensions, we gave a brief overview of non-covered pension (TRS, TMRS, and ORP) and the challenges they can face when it comes to Social Security. In this blog post, we’re going to break down what the WEP is all about and how it might affect you if you’re going through a divorce. We’ll share some helpful tips and insights to make this complex topic a bit easier to understand. So, if you’re at the spot where divorce and planning for retirement meet, especially in the world of teaching in Texas, stick with us. We’re here to help clear things up and guide you through.

Why Does the WEP Even Exist?

The Windfall Elimination Provision (WEP) was enacted with the Social Security Amendments of 1983, a crucial part of reforms aimed at maintaining the Social Security program’s financial health. Before the WEP’s introduction, individuals could exploit a loophole in the system. They might work in high-paying jobs covered by Social Security for a short period, then move to jobs not covered by Social Security, often with generous pensions. When calculating Social Security benefits, which are designed to favor low-income workers with a higher replacement rate, these individuals would appear to have lower lifetime earnings than they actually did. This scenario allowed them to receive Social Security benefits disproportionate to their actual contributions to the system. The WEP was designed to address this issue, adjusting the benefit calculation for such individuals to ensure a fairer distribution of benefits and uphold the program’s integrity.

Who is affected by the WEP?

When we talk about the WEP, the first big question is, “Who does it actually affect?” The WEP might lower the amount some workers get from Social Security if they also have a pension from a job that didn’t pay into Social Security. But, not everyone is affected by this. For example, people who worked for the railroad1RS 00605.362 Windfall Elimination Provision Exceptions – Section B – Item 6 or served in the military2RS 01701.001 Military Pay Coverage and Deemed Military Wages (DMW)3RS 00605.362 Windfall Elimination Provision Exceptions – Section B – Item 44RS 00605.383 Exclusion of Military Reservists from WEP and get pensions from those jobs usually don’t have to worry about the WEP. Also, if you worked for a government that did pay into Social Security5RS 00605.362 Windfall Elimination Provision Exceptions – Section C – Item 1, the WEP won’t affect you. However, it gets a bit more complicated because many local governments and schools have jobs that don’t pay into Social Security but might also offer a separate pension. Figuring out if the WEP applies to you can be a bit tricky because of these different situations.

How Do I Know if WEP Will Impact Me?

To figure out if your job isn’t covered by the usual Social Security rules (which could affect your benefits due to the Windfall Elimination Provision, or WEP), start by looking at your latest pay stub. Check the deductions section; if you see a 6.2% deduction for Social Security (officially called the Old Age, Survivor, and Disability Insurance program), then you’re paying into Social Security.

But what about your past jobs? This part can be a bit trickier. Since 2012, the Social Security Administration doesn’t send out those detailed yearly statements as often as they used to, mainly to save money. Unless you’ve set up an online account, you might only get a statement in the mail every five years, and this can vary by age.

Adding to the challenge, in 2021, the format of these statements changed. They got a visual makeover with more graphics and less text, which meant they stopped showing the full history of Social Security and Medicare earnings year by year. Instead, past earnings are grouped together, making it harder to see the details at a glance.

But there’s a workaround. You can access your full earnings record online at the Social Security Administration’s website (www.ssa.gov), under the “Eligibility and Earnings” section. This detailed record shows all the yearly earnings that were subject to Social Security and Medicare taxes. If there are years with no earnings listed (shown as a $0 entry), it could mean those were years of non-covered employment, which is important for understanding how the WEP might apply to you.

Making the Sausage – The Calculation of the WEP

Let’s break down how the Windfall Elimination Provision (WEP) calculation works in a way that’s a bit easier to digest. Imagine you’re about to retire, and it’s time to figure out your Social Security benefits. The Social Security Administration (SSA) looks at your 35 highest-earning years, adjusts them for inflation, and uses this to work out your benefits. This process helps them come up with something called your Average Indexed Monthly Earnings (AIME), which is super important because it helps determine your Primary Insurance Amount (PIA) – basically, the core of your Social Security benefit that also affects what your spouse or family might get after you.

Now, when it comes to calculating your PIA, the SSA uses a special formula that breaks down your earnings into three parts6RS 00605.021 Computation of the PIA Under the 1978 NS Method, based on how much you made. As of 2024, these parts are: earnings below $1,174, earnings between $1,174 and $7,078, and earnings above $7,079.7RS 00605.900 List of RAW PIA and Family Maximum Computations – Year 2024 – PIA Bend Points They then multiply these parts by different percentages – 90% for the lowest part, 32% for the middle, and 15% for the highest. The total from this calculation is your PIA, but there’s a cap, which in 2024 is set at $3,822.

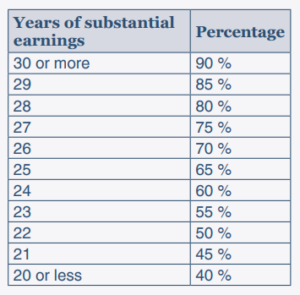

Confused yet? Don’t worry. Here is what you need to know. The WEP only affects the first part of your earnings (the lowest tier), where normally 90% of it would count towards your benefit. If you’ve spent less than 30 years in jobs that do contribute to Social Security8RS 00605.362 Windfall Elimination Provision Exceptions – Section A – Subsection 2, the WEP will lower the percentage of your earnings that count towards your Social Security benefits. Essentially, the fewer years you’ve paid into Social Security, the larger the reduction will be.

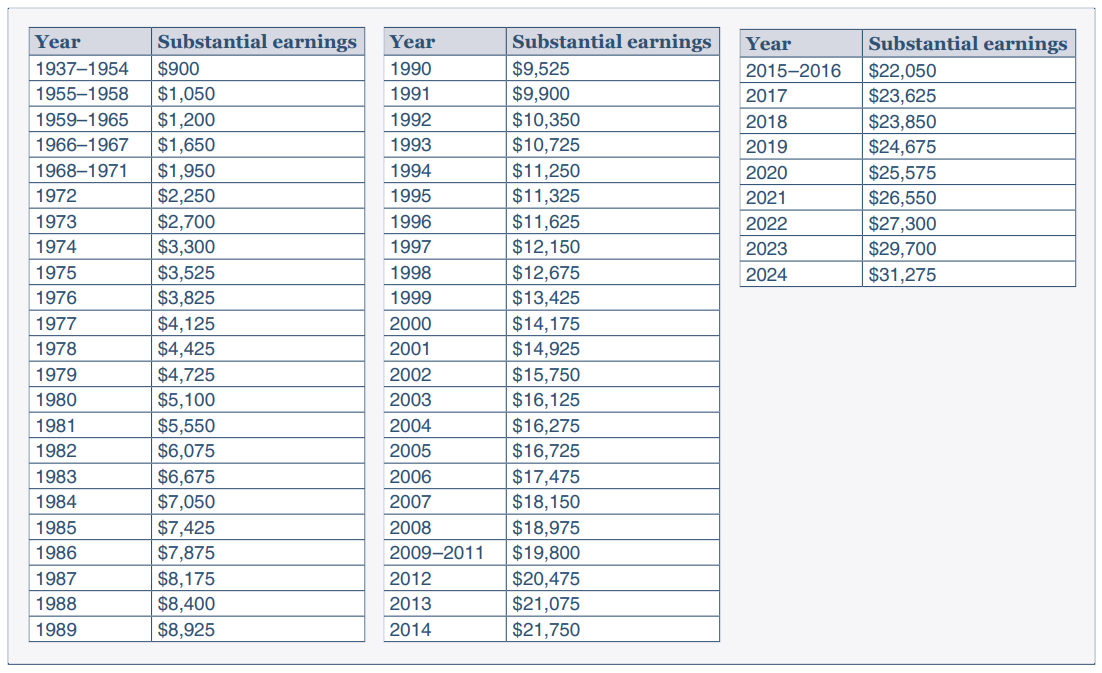

For each year of substantial earnings less than 30, there is a 5% penalty. In 2024, this amounts to a penalty of $58.70 per month your Social Security benefits will be reduced. For example, if you have 25 years of substantial service, the SSA will only count 65% of your lowest earnings tier instead of 90% (.90 – .25 = .65). In this case, the WEP would reduce your Social Security benefit by $293.50 per month.

But don’t worry, there’s a limit to how much the WEP can reduce your benefits. For those with 20 years or fewer of substantial earnings in jobs covered by Social Security, the WEP reduction reaches its maximum limit and does not increase further. For 2024, the most it can take off your monthly benefit is $587. And even better, this reduction can’t be more than half of your pension from the non-covered job. This rule is known as the WEP Guarantee9RS 00605.370 WEP Guarantee, ensuring the WEP doesn’t overly penalize you.

Understanding What Counts as Substantial Income for WEP

When it comes to figuring out how the Windfall Elimination Provision (WEP) might affect you, there are two key tools at your disposal. First, there’s a handy guide from the Social Security Administration (SSA) called “Windfall Elimination Provision” (Publication No. 05-10045). This guide breaks down what counts as substantial earnings year by year and how those earnings could influence the WEP’s impact on your benefits.

Second, the SSA offers an online WEP Calculator. To use either of these resources effectively, you’ll need access to your detailed earnings history, which you can find by logging into your account on the SSA’s website.

How WEP Changes Your Social Security Benefits

When you’re thinking about taking your retirement benefits early, it’s essential to understand how it affects the amount you’ll receive. Let’s simplify how this works:

For the First Three Years Before Full Retirement Age (FRA):

If you retire up to three years early, Social Security is reduced a little bit each month, specifically by 5/9 of 1% for every month you’re ahead of schedule. Add it all up, and if you retire exactly three years early, your total reduction will be 20%.

If You Retire More Than Three Years Early:

Now, if you decide to retire even earlier, more than three years before your FRA, there’s an additional reduction. On top of the 20% reduction for the first 36 months, your MBA will be further reduced by 5/12 of 1% for each extra month you’re retired beyond those initial 36 months.

So, the earlier you choose to dip into your retirement benefits, the more significant the reduction in your monthly payments. It’s a crucial factor to consider when planning your retirement timing.

First WEP, Then Early Retirement

If the Windfall Elimination Provision is a factor, it changes the way your Social Security benefits are figured out. Its leads to a new starting point for your benefits, known as the WEP-adjusted Primary Insurance Amount (PIA).10RS 00605.360 Windfall Elimination Provision – Section 3

Here’s how it unfolds: The WEP first lowers your PIA. Then, if you decide to retire early11RS 00615.101 Reduced RIB – Section 1, say at 62, your benefit already lowered by the WEP gets reduced even more. So, it’s like a double dip – first, the WEP trims your benefits, and then early retirement trims them further. This double effect is crucial to grasp, especially if you’re thinking about retiring early with the WEP in the picture.

But there’s a silver lining if you can wait a bit longer to retire. Say you hold off on retiring until you’re 70, especially if you’re planning to do so in 2024. Doing this not only holds off the WEP reduction but also boosts your benefits by 21%.12RS 00615.690 Delayed Retirement Credits (DRC) This bump can help soften the blow from the WEP, making those extra waiting years worth it.

Going thru a divorce? Questions about your TRS Benefit?

References

- 1RS 00605.362 Windfall Elimination Provision Exceptions – Section B – Item 6

- 2RS 01701.001 Military Pay Coverage and Deemed Military Wages (DMW)

- 3RS 00605.362 Windfall Elimination Provision Exceptions – Section B – Item 4

- 4RS 00605.383 Exclusion of Military Reservists from WEP

- 5RS 00605.362 Windfall Elimination Provision Exceptions – Section C – Item 1

- 6RS 00605.021 Computation of the PIA Under the 1978 NS Method

- 7RS 00605.900 List of RAW PIA and Family Maximum Computations – Year 2024 – PIA Bend Points

- 8RS 00605.362 Windfall Elimination Provision Exceptions – Section A – Subsection 2

- 9RS 00605.370 WEP Guarantee

- 10RS 00605.360 Windfall Elimination Provision – Section 3

- 11RS 00615.101 Reduced RIB – Section 1

- 12RS 00615.690 Delayed Retirement Credits (DRC)

- 13RS 00202.020 Spouse’s Benefits – Payment – Section 1

- 14RS 00605.360 Windfall Elimination Provision – Section C – Subsection 3 – Item d

- 15RS 00605.372 Special Situations Applied To WEP – Section B

- 16RS 00615.201 Reduced Spouse’s Benefits – Section B

- 17RS 00605.401 Recomputations and Recalculations

- 18RS 00615.350 Reduced WIB After or Concurrent with DIB (HA then D/W or HA with D/W)

- 19RS DAL00605.364 Determining Pension Applicability, Eligibility Date and Monthly Amount for WEP (RTN 22 – 10/2013)

- 20RS 00605.366 Pension Development